- Customers

- Customer View

- Subscriptions

- Invoices

- Payments

- Manual Payments

- Live Payments

- Payment Methods

- Customer Contacts

- Customer Notes

- Batches

- Early Admin

- Early Invoice

- Early Batches

- Adjustments

- eMandate

Documentation

Manage Taxes

Bill Again allows you to specify tax rates for specific regions in which your Customers may be. These tax settings are saved to specific Countries and States within these countries and will automatically be charged to Customer invoices if they are saved to a region to which these tax setting apply.

Tax Settings Overview

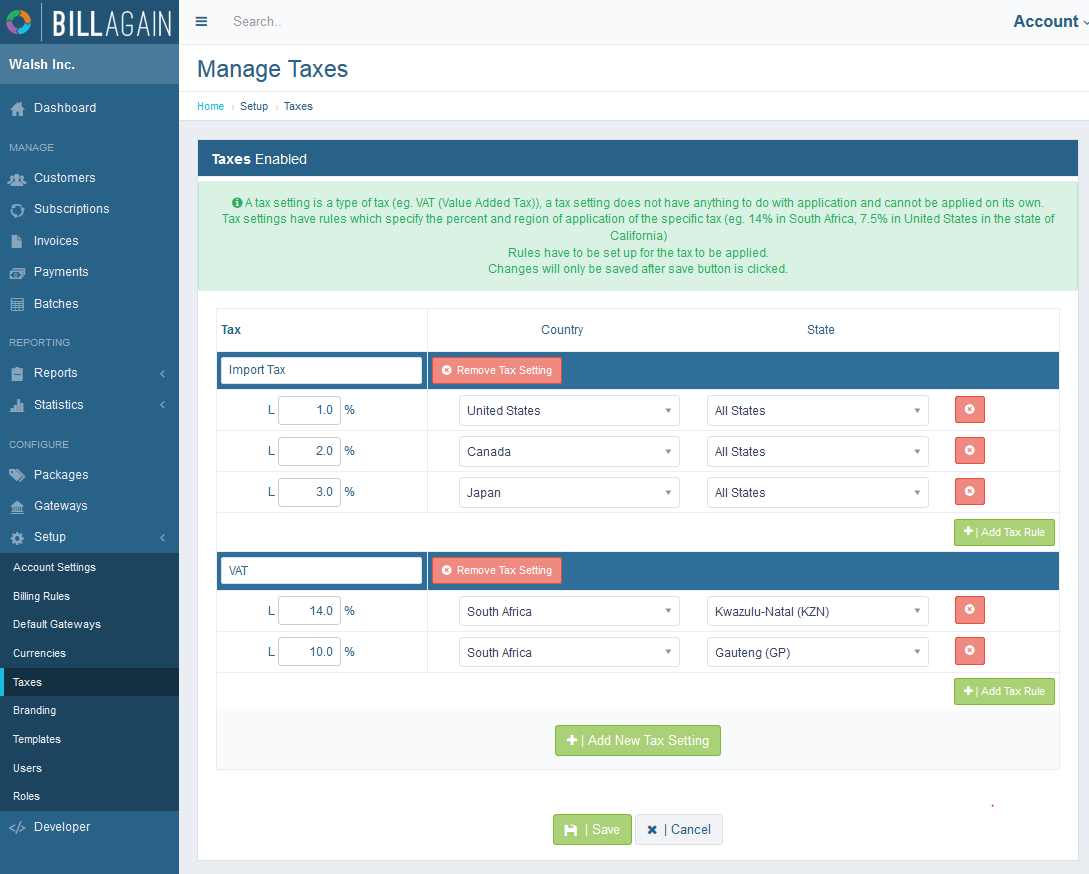

Clicking Taxes from the left hand main menu loads the Manage Taxes page from which you can manage the Tax settings of your Customers. The Tax Settings page is a table formatted list of all the Tax Settings currently saved to your account, as shown below: .

This screen provides immediate, summary-based information for currently saved Tax Settings as well as giving the user the following options for adding and maintaining Tax settings: .

- Adding a new Tax Setting

- Add Tax Rule for specific region

- Remove Tax Setting

- Remove Tax Rule

- Saving and Cancelling changes

There two types of items relevant to Taxes used for managing the taxing process. These items are: Tax Settings and Tax Rules. What these items imply, how they are used as well as maintained will be discussed below in their separate sections. .

Tax Settings

Tax Settings serve as groups according to which rules for specific regions are contained and identified by for use. The rules specified within these will automatically be applied to Customers if the Customer falls within the setting’s region. .

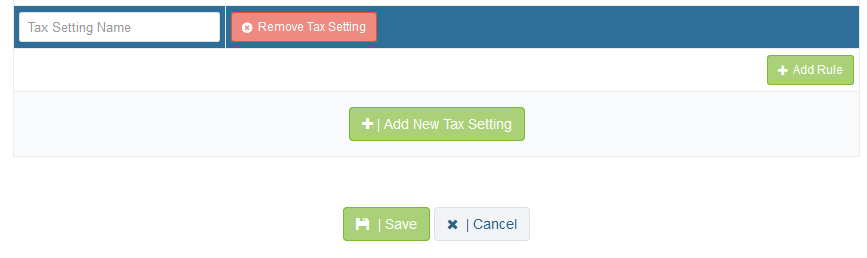

To add a Tax Setting select the Add new Tax Setting at the bottom of the page. This will create a blank text setting box within which you will be required to enter a name. This name will be used across the application to identify the rules specified for specific regions. Once a name has been entered select the Save button on the bottom of the page. It is important to note that the changes you made will be lost if the save button is not clicked. Conversely clicking the Cancel button at the bottom will discard any changes made. .

Tax Settings can be deleted from the system by clicking the Remove Tax Setting button next to an existing Tax Setting. Please note that this will remove all Tax rules contained within it as well which means they will no longer be applied to Customers or their invoices. After deletion it is also necessary to confirm your delete by clicking the Save button on the bottom of the page. .

Tax Rules

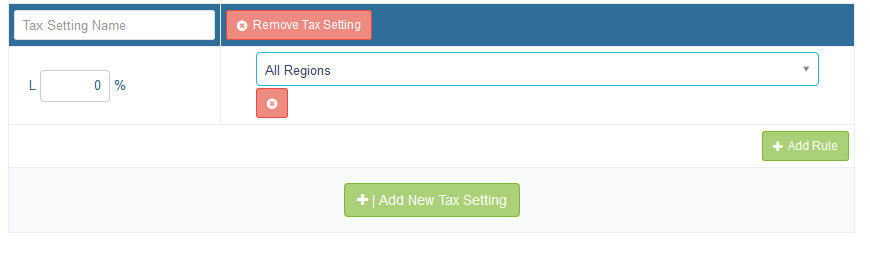

Tax Rules are the actual percentage of tax charges which will be applied to invoices and payable to clients falling in the rule’s specified region. Tax rules are contained in and identified by the Tax settings in which they are added. For each Rule you need to specify the Region, which will typically be a Country, as well as the state or province to which it will apply. Selecting a State is optional while selecting a Region is required. Alternatively you may specify that the Tax Rule will apply to all Regions. .

These specified percentages will automatically be calculated and added to Customer invoices depending on the Customer’s specified region. Please note that if a Customer’s saved region does not reflect that of a Tax Rule, the rule will therefore not apply or be added to the Customer’s invoice. .

To Add a Tax Rule, click the Add Tax Rule within an existing Tax Setting group. This will a blank Tax Rule within which you are required to specify the details of the new Rule. Within this blank Rule you then enter the percentage tax payable by the customer in the “%” box as well as specify the Region and States to which the rule will apply in the boxes to the right. Once all the Rule’s details have been entered select the Save button at the bottom to register the new rule to your system. It is important to remember that failing to click the Save button will result in your changes being lost. Conversely .

To delete a Tax Rule, simply click the delete button, which contains an “x” icon, next to the Rule you wish to remove. Once removed select the Save button at the bottom of the page to confirm this deletion. .

Manage Taxes

The Manage Taxes page will list all the currently registered Tax settings and allow you to Add, Edit, Delete and View Taxes.

Tax Settings

Tax Settings are groups or Tax names/types that contain Tax Rules for specific regions.

Tax Rules

Tax Rules allow you to specify specific tax terms for specific regions according to a Tax type or Setting.